The CFO Rewired: How the Role Transformed in 2025 and What Founders and Investors Should Expect in 2026 | Zanda Blog

18 Dec, 20258

Introduction

If you spent time around high-growth companies in 2025, you probably noticed the shift: the CFO role did not simply evolve; it expanded.

What used to be a role defined by stewardship, control and financial hygiene has expanded into something far broader and far more critical. Over the past year, the CFO remit has undergone a dramatic shift and many organisations are still catching up.

2025 Was the Year the CFO Became Something Else Entirely

The modern CFO is no longer simply the person who keeps the books clean.

They have become the person who brings order to complexity, turns data into direction, and supports or challenges the CEO at the moments that matter most.

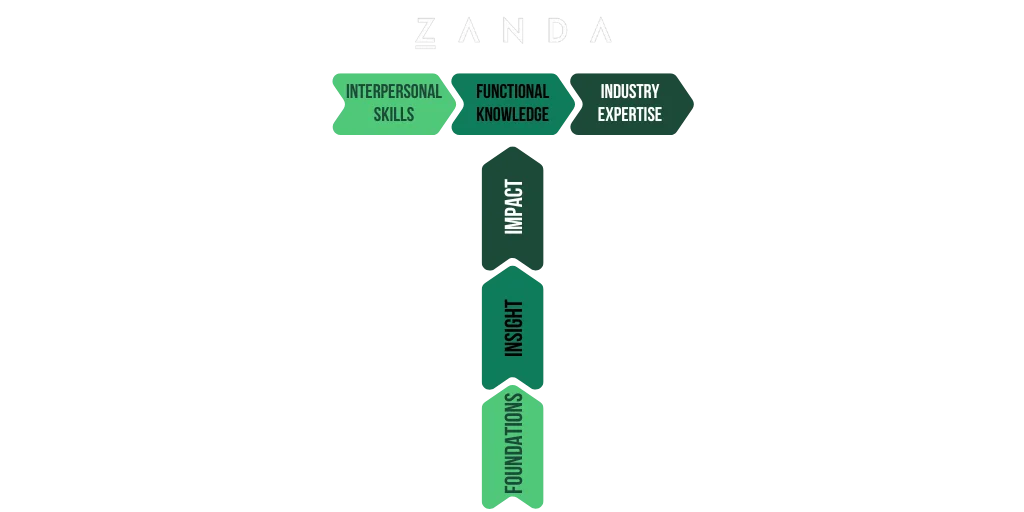

Today’s CFO spans strategy, capital allocation, systems, operations and leadership. Someone who can turn chaos into clarity and ambition into execution.

They are, in equal parts:

- strategic operator

- data architect

- commercial co-pilot

At Zanda, we have watched this evolution unfold across hundreds of conversations with founders, investors and finance leaders. And one thing is clear: the talent playbook for CFOs has changed. Companies that cling to the old definition of the role are already being left behind.

This article explores how the role evolved, why the shift happened so suddenly, and what founders and investors need to consider as we move into 2026.

2025: The Year the Traditional CFO Profile Broke

For much of the past decade, companies often prioritised candidates with strong accounting foundations, governance experience and a reputation for reliability.

Whilst these skills still remain valuable they are no longer proving sufficient as scaleups encounter faster product cycles, more demanding investors and increasingly dispersed systems, the responsibilities of the CFO widened considerably.

The CFO became central to strategic planning, data integration, cross-functional alignment and operational clarity. Finance leadership is now only one part of the job; the rest lies in enabling the business to make better decisions at pace.

The CFO now owns or meaningfully influences:

- Capital strategy, funding and runway control

- Unit economics and pricing

- Capital allocation and growth trade-offs

- Investor relations

- Data integrity, BI, automation and efficiency

- Operating cadence

- CEO partnership and decision velocity

The role now sits at the intersection of strategy, data, execution and capital, not simply finance.

Why the Shift Happened and Why It Is Not Slowing Down

Capital discipline became a competitive advantage

Boards and investors placed a renewed emphasis on evidence-based decision-making and the thoughtful management of cash and runway. CFOs needed to balance growth and discipline without allowing either to compromise the other.

Data fragmentation became a serious operational tax

Many scaleups struggled with inconsistent or disconnected data, which slowed execution and obscured performance. CFOs increasingly became responsible for building coherent systems and operational structures that created visibility and reduced inefficiency.

The pace of business outgrew traditional finance models

With AI-enabled GTM motions, rapid product updates and international expansion, companies needed finance leaders who could think and act like operators. This required a broader skill set than the traditional controller profile could offer.

The result is a CFO who is more integrated across the business, more technically fluent and far more influential in shaping direction.

The Five CFO Archetypes Emerging For 2026

Across our searches in 2024 and 2025, five profiles repeatedly proved to be the most successful:

The Step-Up CFO

Often a VP or FD making the transition to CFO, this profile brings curiosity, adaptability and strong alignment with founders. They tend to be effective in early and mid-stage businesses that value speed of learning and hands-on leadership.

The Scaleup Specialist

These leaders have guided companies through significant growth journeys and understand how to stabilise operations while expanding rapidly. They excel in environments where complexity is increasing and operational maturity is required.

The Investor-Turned-Operator

With backgrounds in VC, PE, banking or strategy, these CFOs bring a strong understanding of value creation, corporate development and capital allocation. They are particularly valuable for businesses approaching major strategic or fundraising milestones.

The Digital CFO

A growing but limited talent pool, these leaders focus on AI-Native finance platforms, resolving systems fragmentation, building real-time reporting, integrating finance with commercial teams and leading automation initiatives. Their work often unlocks new levels of operational efficiency.

The Global Import

More European businesses are hiring US-trained CFOs, particularly for later-stage roles. Experience working at larger scale and faster operational cycles can be extremely beneficial for companies preparing for significant expansion.

What Founders and Investors Will Need From CFOs in 2026

A clear pattern is emerging in what boards, founders and investors are prioritising. The CFO is now assessed less on traditional finance leadership alone and more on their ability to support decision-making, create clarity and operate as a true partner to the leadership team. Outlined below are the priorities that reflect this shift:

Adaptability over pedigree

The ability to operate effectively in changing conditions is now more valuable than a conventional, linear CV. Founders increasingly seek CFOs who can interpret complexity and adjust quickly.

Technical fluency across systems and data

CFOs are now expected to oversee BI, automation, integrations and reporting infrastructure. This is essential not only for visibility but for decision-making across the entire organisation.

A broader commercial perspective

The modern CFO works closely with product, sales, RevOps, people and marketing. Their role is to understand the commercial drivers behind performance and help teams make informed choices.

Leadership that inspires trust

Beyond technical skill, CFOs now serve as a stabilising force. They must communicate clearly, work constructively with founders and provide teams with clarity during periods of change.

Maturity in capital allocation

Scenario modelling, investment evaluation, runway stewardship and fundraising preparedness are all central to the remit. Boards increasingly expect CFOs to play a decisive role in shaping investment decisions.

How Zanda will be securing the best CFOs in 2026

The approach that worked five or ten years ago no longer delivers reliable results and therefore we will be working with companies to provide a more thoughtful and forward-looking hiring process.

Starting earlier than you think

Exceptional candidates are rarely available on demand. Beginning the process early creates space to build relationships with the right people rather than relying on whoever is immediately available.

Focus on the next two years, not the last two

A successful search is defined by what the business will need during its next stage of growth. Anchoring the process in past challenges often leads to misalignment and missed opportunities.

Define the role with precision

Define the role by matching it to where the business is today. Some organisations need a CFO who can build core systems, while others require experience with scale or strategic change. Prioritising the capability that matters most leads to better hiring decisions.

Sell the mission, not only the metrics

The strongest CFOs gravitate towards roles where the mandate is well defined. Founders who can articulate their ambitions, priorities and decision-making structure create a more compelling proposition and attract candidates who are aligned with the mission.

Final Thoughts

If 2024 was about stability and 2025 was about evolution, then 2026 will be defined by acceleration. The CFO has become a central driver of scale, operational excellence and enterprise value. Companies that recognise this shift will attract stronger talent, operate more efficiently and build more resilient organisations. Those that do not will likely feel the impact in slower cycles, operational friction and weaker financial performance.

The CFO remit has changed permanently, and the organisations that understand this now will set the pace for the coming decade.